Can You Have a Coverdell and 529 Plan

Get Rid of Your 529 Plan, Open a Coverdell

Equally university costs increment at an average inflation rate of 8% a year, how does someone try to save for a college degree? Many fiscal advisors and journalists preach the importance of opening a state 529 plan. However, how many parents are actually fully funding these plans to pay for all four years? I'll explicate the drawbacks of the 529 plan further and why I started the Coverdell Pedagogy Savings Account when my kids were built-in. I consider it superior to the 529 programme in several means, IF it is done right.

529 Plan Background

The 529 program is a tax-advantaged savings programme created for individuals to relieve for a child's instruction costs. They are known as "qualified tuition plans". In that location are 2 types of 529 plans:

· Prepaid tuition plans

· Instruction savings plans

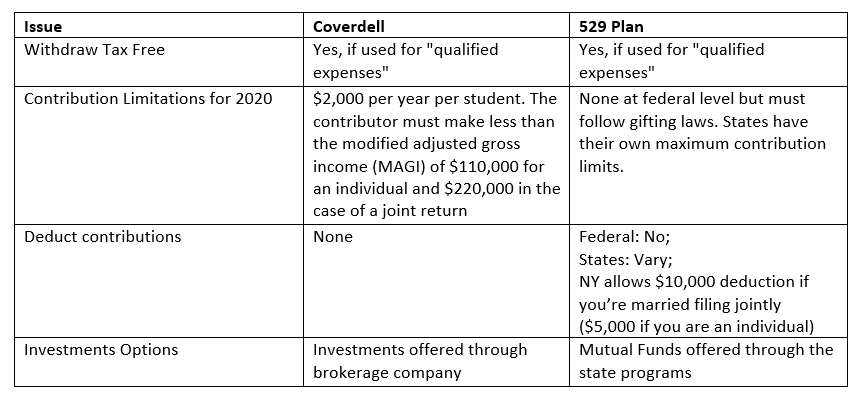

Prepaid tuition plans just exist in ten states and then it's not very common. I will focus on the didactics savings plan where individuals tin contribute dollars into an account and volition have to invest the proceeds. Since they are revenue enhancement advantaged, the earnings in the account grow taxation-deferred. Withdrawals are revenue enhancement-complimentary as long every bit it's used for qualified teaching expenses. Every state's plan is slightly different and you don't take to open a 529 plan in your resident country. I recommend researching your particular state'south programme to meet if in that location is an reward. Since I alive in New York state, I will focus on that 529 plan. Ane of the advantages of the New York state programme is that contributions up to $10,000 have a state tax benefit if you're married filing jointly ($5,000 if you are filing as an individual). You lot are able to deduct that amount from your state taxes only not your federal taxes.

The New York 529 plan provides two options:

ane. Y'all can set upward a Direct Plan incurring a 0.13% total almanac nugget fee in addition to the expense ratio fees in the common fund. The Vanguard mutual funds in the New York plan charge very low expense ratios. Even so, the annualized returns accept not been spectacular.

two. You tin can utilize an advisor who assists you with the investment options so you would incur higher fees. The type of share form you purchase determines the fees your investment incurs.

Many of the funds in the New York program have not performed well since inception. The Vanguard Total Stock Market place Index Fund has just returned 8.52% annualized since inception.

Many financial pundits including Warren Buffett who I greatly adore and respect recommend investing in a passively managed index fund like the Vanguard Total Stock Market place Index Fund. When I analyze the cost of college tuition, it has unfortunately, increased at an viii% inflation charge per unit. Even if we assume (peradventure incorrectly) that the 529 Plan can generate a 10% annualized return, we will only achieve a real return of ii%. That percentage does non provide a saver any ability to grow their investment amount to a substantial sum unless they initially started with a large residual. In theory, I would need to eolith my kid's entire cost of their four years of undergraduate study at present in lodge to keep up with college aggrandizement. Co-ordinate to US News and World Report, the average annual toll of a individual university is about $41,000 which is low compared to the price of an Ivy League schoolhouse. Thus, I demand to deposit $164,00 today to cover iv years of education based on the boilerplate yearly cost.

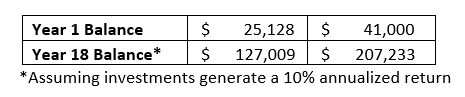

Co-ordinate to the College Savings Plan Network, the average balance in a 529 plan accounts is currently $25,128. Allow's assume that you lot merely had a child and was able to deposit that exact corporeality into your child's 529 plan. Assuming return of investments of ten%, hither is a chart of where that residue would be in 18 years if you lot started with $25,128 vs $41,000 (electric current price of the beginning year) and you decide non to invest whatever more assets into the 529 plan.

In 18 years, if college aggrandizement is growing at 8% per year annualized, y'all'll need $151,700 for the first year. If you manage to invest $25,128 when your kid was born, you won't take enough to pay for the first year. To cover the entire four years of education, you'll need a full of $683,581.

What's the Better Culling to the 529 Plan?

I highly recommend setting up a Coverdell Education Savings Account which tin can be gear up up at whatever brokerage company. Unfortunately, many people don't talk about this account. For the finance manufacture, nobody makes money from the Coverdell account. For example, in the New York 529 plan, the administrator and mutual fund visitor generate income when you lot invest through their plan through the fees they charge. If you lot employ an advisor, s/he makes money from it. In the Coverdell, you have the option to invest in any security including, but not express to stocks, bonds, and mutual funds. Your brokerage company does non make money from you lot when you lot open a Coverdell account. If you lot select a mutual fund to invest in the account, the fund company does make coin through the expense ratio.

The Coverdell Basics

The Coverdell is a tax-advantaged education savings account where the growth is tax deferred and withdrawals are tax-free equally long as they are deemed qualified expenses. The IRS clearly defines the definition of qualified expenses in Publication 970. You are required to maintain good records in case of an audit. Similar the 529 plan, you can utilize this to pay for private school from K-12 and college education costs. The Coverdell account must be used before the child turns thirty unless they are categorized equally special needs.

The Coverdell has a contribution limit of $2,000 per kid per yr. Also, the person who contributes to the Coverdell account must make less than the modified adjusted gross income (MAGI) of $110,000 for an individual and $220,000 in the case of a joint return. IRS Publication 970 also explains the nuances with this account and the 529 plan which they phone call Qualified Tuition Programs (QTPs). However, since this is not administered by the state, you practice not have any tax deduction at the state or federal level. Like the 529 plan, a big drawback is that the Coverdell counts confronting your kid's financial aid eligibility. Here's an article highlighting that fact. You should consult with your revenue enhancement advisor to thoroughly appraise if the positives outweigh the negatives for your detail situation. If you are not able to contribute due to the income limitations, other family unit members or friends tin contribute to the Coverdell account that benefits your child.

The earlier you start, the better. If y'all can offset contributing to this when your child is born and continue to max out the annual $2,000 limit, y'all can start edifice wealth in the account sooner. Anyone familiar with the time value of money and chemical compound interest will tell you the importance of kickoff as presently every bit possible. In addition, the biggest benefit is the power to self-straight the account to invest in whatsoever available asset in your brokerage account. The selection of your investments is the most crucial aspect to grow this account and I recommend you do it cautiously. I will tell you what I have washed but this is NOT investment advice. You should invest at your own adventure and conduct your own due diligence before making any investments.

How Did I Select My Investment?

I am very bullish on bitcoin and believe that the current price is non reflective of the recent bitcoin halving event which I spoke about in this article. I likewise believe the printing of fiat currency by Fundamental Banks around the world might accelerate the adoption of bitcoin. When my first child was born, I opened up the Coverdell and purchased bitcoin in the account. There was only ane method to purchase bitcoin easily into the account. I had to buy the Grayscale Bitcoin Trust which is publicly traded under the symbol GBTC. Any bitcoiner volition inform you that purchasing GBTC is not the same as owning bitcoin every bit a sovereign asset. Thus, in that location are inherent risks owning this through Grayscale such equally custodial and direction risks including some others. I recommend you evaluate them on your own to make up one's mind if this is right for you.

I don't want my child to graduate with student loans. When I opened the Coverdell, I wanted to invest it in an asset that can produce disproportionate returns. When I fell downward the proverbial bitcoin rabbit pigsty, I devoted my life to learning about the applied science. Since I understood bitcoin better than Tesla, Alphabet Inc, and Apple, I decided to invest all the funds into the Grayscale Bitcoin Trust. For this account to piece of work for me, I needed to invest in an nugget that could produce a very loftier render. Even so, there is a chance that I could lose everything in this account. When I make up one's mind on an investment, I evaluate all the risks and assign a probability for each factor. Essentially, I try to de-risk my investment. You might understand another company meliorate than me that could produce the same blazon of returns. I would recommend selecting an investment that yous researched thoroughly for the Coverdell.

Followers of this Trust product will notation that it has historically traded at a premium to the Internet Asset Value (NAV). In other words, you lot are paying more than for the assets held in the trust. Recently, the premium has been effectually xx% which is fairly low but the premium has dropped to zero in March of 2022 which I discussed here. Past contrast, in December 2017, the premium peaked at over 100%. Historically, I take paid the premium when it was low in order to grow the Coverdell. This is another risk factor investing in this product. If a bitcoin ETF (commutation traded fund) is approved past the SEC (Securities and Commutation Commission), then the premium will disappear. Until so, the premium might mayhap hold.

A pseudo-bearding person named Programme B has created a stock to menses model that values bitcoin based on its issuance rate. Co-ordinate to his dissimilar models, he believes bitcoin could reach a high of $100,000 to $300,000 during the next bull run. Hypothetically, if bitcoin tin attain the low-finish price of his model, GBTC could generate a 10X return. It might be perhaps higher if the premiums likewise increase. In theory, your initial investment of $ii,000 might be worth $20,000. All that growth is revenue enhancement deferred and the withdrawals are tax free as long every bit information technology is used for qualified expenses as defined past the IRS.

Now the Coverdell is not your only option to invest in your child's education. The Journal of Accountancy recently published an article on utilizing your Roth IRA versus a 529 plan. I present this here to demonstrate there are other alternatives. You need to evaluate what the best selection is for you.

My Brief Perspective on College Education

Many fiscal gurus discuss how student loans are adept loans since y'all are making an investment in your futurity. However, I would counter that all loans are bad loans. Many students are graduating with such a burden from college debt that this is now a modern-solar day version of indentured servitude. Unless your family is able to pay for your higher costs, I call back in that location needs to be more discussion over the toll of a four-twelvemonth undergraduate degree where students need to try to graduate debt costless. Considering metropolis/state universities that offering lower tuition, and/or schools close to home to avert room and board are some means to reduce the overall toll of college as well.

There are many methods to reach this such as applying for scholarships and merit-based aid. However, if yous don't believe you lot can receive that, there are plenty of options to obtain a solid teaching without graduating with a debt brunt. In my own experience, I fabricated the fault as an undergraduate where I had a few educatee loans to pay for part of my room and board. I could accept paid it off sooner merely stuck to the payment plan. When I went to graduate school, I would not echo the same mistake. I decided to attend Baruch College considering the education quality is high and the price was affordable generating a high return on investment. I was able to work while attention school simultaneously. When I graduated, I did not have any student loans. This was not an easy task. In 2019, Kiplinger ranked Baruch Higher equally one of the best higher values with 1 of the lowest average graduating debt. The school has only near 14% of students who need loans and the average debt at graduation is $12,117. Co-ordinate to credit.com, the average college debt in 2022 was $31,172 per student. I would prefer if the debt load is zero for Baruch College graduates just they do accept an advantage over students who graduate with larger loan burdens.

I recommend students start to think about their lifetime earnings after they graduate. In other words, think virtually the return on investment for your higher education. If you lot take a passion for didactics in a public school, you can easily google your annual salary. Public school teachers are unfortunately, very underpaid and incurring large amounts of student loans to obtain a degree may not be worth it. A popular argument is that the college experience is priceless. However, this burden has started to delay the younger generation from starting families. I would fence a better experience might be to follow the Western European model and take a gap year. This is where they take a yr off either before or afterwards college to visit countries and learn most other cultures. As we become a global society, this experiential learning can be very impactful for an individual. Rolf Potts wrote a book called Vagabonding- education people how to travel the world for a longer period of time and utilizing different ideas to stretch your budget. I had a colleague who traveled the world for a year. He met his time to come wife in Southeast Asia and became a reality star there. I'm certain he didn't program all of that to happen. No, he is not on 90 Day Fiance.

Hasan Minhaj recently focused on answering the question, "Is Higher Nonetheless Worth It?" The pandemic has caused many classes to move online. Parents are questioning if the price of college is actually worth all the coin. Professor Scott Galloway at New York University (NYU) has publicly stated that he believes the tier 2 and tier 3 schools are going to see price force per unit area and they will witness a destruction of pricing ability. Many of those colleges could effect in a "death march", meaning they will have to shut downwardly. He said "We have raised tuition rates 1,400% over the last 40 years. This is a time of year that'southward supposed to be a nervous but a rewarding fourth dimension of year where people figure out where they're going to school, and instead information technology'southward become a time of twelvemonth where people try to imagine how they're going to accept several 1000 dollars on in-household debt."

I also don't believe everyone needs to attend college. Alternatives such equally merchandise schools provide bang-up career opportunities just I will leave that for another give-and-take. The narrative that we have to attend college, obtain educatee loans, and get a practiced task probably needs to be revisited.

Is the Coverdell Right for You?

You lot take to make the decision to see if the Coverdell makes the nearly sense for your child(ren). In my opinion, the ability to select whatsoever investment available in a brokerage account is a huge reward if you are able to select the correct investment to produce outsized returns. Notwithstanding, if yous plan to invest in an S&P 500 index fund, the Coverdell might not exist the right vehicle for yous. You exercise have the option to invest in both the 529 plan and Coverdell. Y'all have to decide what is the best strategy for you. In the end, I can't provide any recommendations or advice. Every person's financial situation is dissimilar so consult with your qualified tax advisor or financial planner for your personal situation.

Disclosures

I ain bitcoin (BTC) and the Grayscale Bitcoin Trust (GBTC). All investments involve gamble of loss. Nothing said in this article should exist construed every bit investment advice. Whatever reference to an investment's past or potential functioning is not, and should not be construed as, a recommendation or every bit a guarantee of any specific outcome or turn a profit. Invest at your ain risk. Caveat Emptor.

DISCLAIMER

The author does non warrant that the data will be gratis from error. None of the information provided in this article is intended as investment, revenue enhancement, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or every bit an endorsement of any visitor, security, fund, or other securities or non-securities offering. The data should not be relied upon for purposes of transacting securities or other investments. Your utilize of the information is at your sole hazard. Under no circumstances shall the writer exist liable for whatever straight, indirect, special or consequential damages that result from the apply of, or the disability to use, the materials in this site, even if the author has been advised of the possibility of such damages. In no outcome shall the author have whatsoever liability to you for damages, losses and causes of action for accessing this site. Information on this website should non exist considered a solicitation to buy, an offering to sell, or a recommendation of any security in any jurisdiction where such offering, solicitation, or recommendation would be unlawful or unauthorized.

All written content in this article is for information purposes only. Opinions expressed herein are solely those of the author, unless otherwise specifically cited. Material presented is believed to be from reliable sources and no representations are fabricated by the author equally to some other parties' advisory accuracy or completeness.

Source: https://medium.com/@charleshwang8/get-rid-of-your-529-plan-open-a-coverdell-47635bdfbdf4

0 Response to "Can You Have a Coverdell and 529 Plan"

Post a Comment